Account number of the customer(s) of the depositary bank.

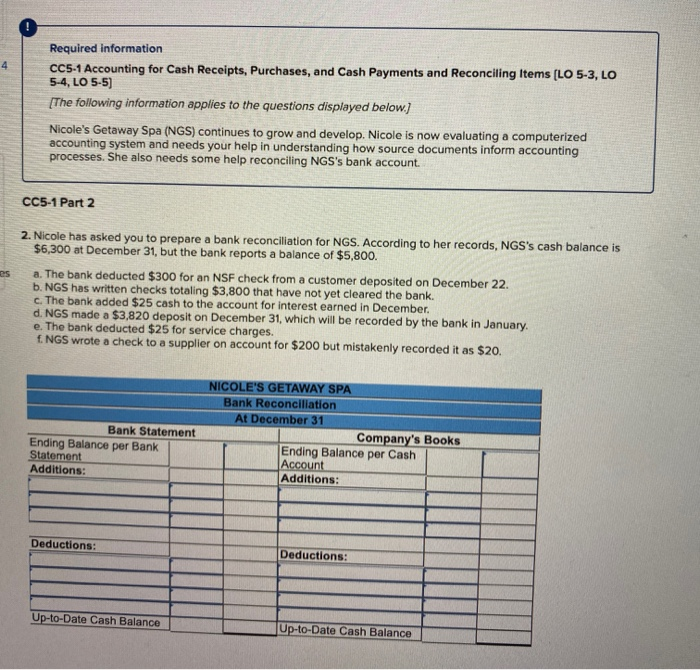

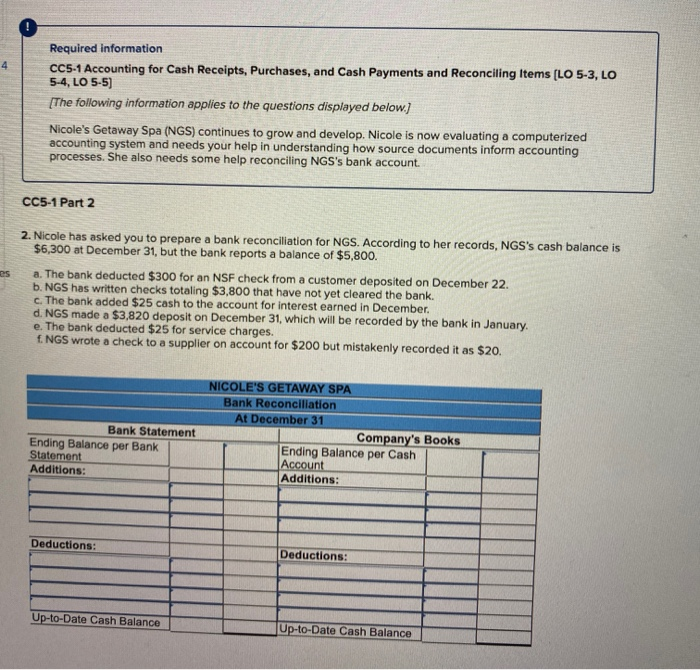

Date of the endorsement of the depositary bank. Name and routing number of the paying bank. The notice can be provided by the return of the check/item, or through the use of a written notice that contains the following information: Under the current rule, for the notice to be timely, the notice must be received by the depositary bank no later than 4:00 pm (local time of the depositary bank) of the second business day following the banking day the check was presented to the paying bank. If the returned (unpaid) check is $2,500 or more, the paying bank must provide a notice of nonpayment. Under the current requirements of Regulation CC, in order for a return to be “expeditious,” the paying bank must return the check as provided under either the “two-day test” or the “forward-collection test.” (§229.30) Under the “two-day test,” the paying bank has to return the unpaid check to the depositary bank by 4:00 pm (local time of the depositary bank) of the second business day following the banking day the check was presented to the paying bank. To that end, the regulation requires a paying bank (the bank where a check is drawn) to return a check “expeditiously” when the bank makes the decision to not pay a check (i.e., due to insufficient funds, unauthorized signer, account closed, etc.). In theory, by expediting the processing of checks, institutions are able to reduce the amount of time a check is placed on hold. The regulation isn’t just about how long funds are placed on hold, but it also requires the timely processing of checks. Regulation CC was created by the Expedited Funds Availability Act and the name “Expedited Funds Availability” says it all. Regulation CC has specific provisions relating to the processing of returned items (i.e., unpaid checks, including checks designated “not sufficient funds,” or NSF). But there is always the possibility that the Regulation CC availability of funds rules could change in the future!Īlthough changes were made in multiple sections of the regulation, the core of the changes are in Subpart C, and they center on the collection and processing of checks and returned checks. You won’t need to adjust your training, procedures, disclosures, and policies relating to funds availability-at least not as a result of the current updates.

Date of the endorsement of the depositary bank. Name and routing number of the paying bank. The notice can be provided by the return of the check/item, or through the use of a written notice that contains the following information: Under the current rule, for the notice to be timely, the notice must be received by the depositary bank no later than 4:00 pm (local time of the depositary bank) of the second business day following the banking day the check was presented to the paying bank. If the returned (unpaid) check is $2,500 or more, the paying bank must provide a notice of nonpayment. Under the current requirements of Regulation CC, in order for a return to be “expeditious,” the paying bank must return the check as provided under either the “two-day test” or the “forward-collection test.” (§229.30) Under the “two-day test,” the paying bank has to return the unpaid check to the depositary bank by 4:00 pm (local time of the depositary bank) of the second business day following the banking day the check was presented to the paying bank. To that end, the regulation requires a paying bank (the bank where a check is drawn) to return a check “expeditiously” when the bank makes the decision to not pay a check (i.e., due to insufficient funds, unauthorized signer, account closed, etc.). In theory, by expediting the processing of checks, institutions are able to reduce the amount of time a check is placed on hold. The regulation isn’t just about how long funds are placed on hold, but it also requires the timely processing of checks. Regulation CC was created by the Expedited Funds Availability Act and the name “Expedited Funds Availability” says it all. Regulation CC has specific provisions relating to the processing of returned items (i.e., unpaid checks, including checks designated “not sufficient funds,” or NSF). But there is always the possibility that the Regulation CC availability of funds rules could change in the future!Īlthough changes were made in multiple sections of the regulation, the core of the changes are in Subpart C, and they center on the collection and processing of checks and returned checks. You won’t need to adjust your training, procedures, disclosures, and policies relating to funds availability-at least not as a result of the current updates.

And depending on your perspective, this is a good thing. Just to be clear, the updates to Regulation CC do not include changes to the timeframes funds can be available, disclosures, or coverage. The changes relate to check processing and collection, not to the availability of funds, and unlike previously, the changes now recognize the processing of electronic checks and electronically-created items. However in May 2017, the Federal Reserve Board announced updates to Regulation CC that are effective in July 2018. Until last year, Regulation CC had not changed in about a decade, which allowed us to become comfortable with the regulation and how check processing should operate.

0 kommentar(er)

0 kommentar(er)